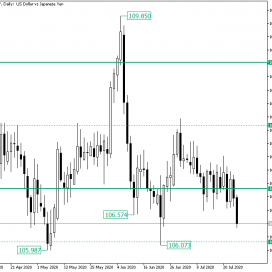

Home / Forex news / USD/JPY About to Test the 106.12 Level

The United States dollar versus the Japanese yen currency pair seems to have been taken over by the bears. Do the bulls stand a chance at 106.12?

Long-term perspective

The fall from the 109.85 high extended, in a first instance, until the 106.57 low. From there, the bulls tried to recover, but, even if they were able to close a candle above the level, the bears had the power to send the price to 106.12, printing the 106.07 low.

Still, from the 106.07 low, the bulls initiated yet another push, this time not only closing the day above the 107.00 psychological level but also extending their gains until the 108.05 intermediary level.

Upon reaching 108.05, the price retraced towards the 107.00 level, and the bulls started new efforts to validate the level as support. Nevertheless, they were more struggles than just efforts, as every appreciation got invalidated.

Of course, this evolved in the most natural way, that is the 107.00 level gave way, the price — as of writing — trading at 106.45.

Likely is for the current movement to continue, targeting the firm support of 106.12. This may come after a short-lived consolidation phase, like a pennant or a flag, or simply as a continuation of the current fall.

Once the price reaches the 106.12 level if the bears have enough steam — and they should, considering the consolidation that took place in the 107.00 area — then they could pierce it, heading towards 105.09 — not highlighted on the chart. Otherwise, the bulls could print another rise towards 107.00.

Short-term perspective

After confirming the major 108.02 level as resistance, the price retraced, consolidated above 107.34, and then slipped under it. What followed was another consolidation phase, limited by 107.34 as resistance and 106.77 as support, that eventually allowed the continuation of the depreciation.

In the current situation, the price may simply continue heading for 106.02. Another possibility is to see the price throwing back to 106.77 to validate it as resistance.

Only if the bulls regain 106.77, then they could try a new appreciation. However, it could be limited by the descending trendline.

Levels to keep an eye on:

D1: 106.12 105.09 107.00

H4: 106.77 106.02 107.34

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “USD/JPY About to Test the 106.12 Level”