Home / Forex news / USD/JPY Beneath the Important Support of 105.09

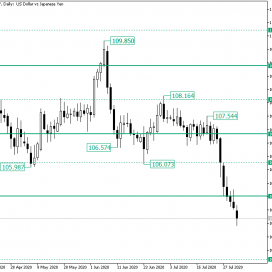

The US dollar versus the Japanese yen currency pair slipped under the important 105.09 level. Can the bulls deliver a surprise comeback?

Long-term perspective

After the depreciation from the 109.85 high, the bulls were only able to make ill recoveries, their best efforts printing the 108.16 high.

The last high — a lower high — was 107.54 which, given the context, offered the bears the required confidence to push the price lower.

As a result, the sellers put a lot of pressure on the 106.12 intermediary level. For a while, it seemed that the level holds, but in the end, it gave way, allowing the depreciation to continue towards the firm 105.09 support.

However, the bears were so decided, that 105.09 got passed with relative ease.

From this point onward, one possible scenario is for a consolidation to take place, one that should be limited by 105.09 as resistance. Another possibility is for a throwback to develop. If this happens, then 105.09 would be firmly confirmed as resistance, which in turn would open the path to 103.15.

Of course, the movement could simply continue, as a steady fall towards 103.15. But if the bulls manage to bring the price back above 105.09, then they could try another rise, with 106.12 as a target. If they would actually be ready to push the price vigorously towards the north, remains to be seen. Because if they get the price above 105.09 but no further advancement takes place, just like in the case of the 108.16 high, then 103.15 would only be a matter of time.

Short-term perspective

The fall from 107.22 extended until the solid support level of 104.44. If the price finds support in this area, then rise until the 105.27 level would be possible.

If the bulls manage to conquer 105.27, then they could head on for 106.02. But if 105.27 limits any appreciation, then the bears could once more attempt to send the price towards the south. As a course of this possibility, if 104.44 cedes, then 103.09 (not highlighted on the chart) would be the next bearish target.

Levels to keep an eye on:

D1: 105.09 103.15 106.12

H4: 104.44 105.27 106.02 103.09

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “USD/JPY Beneath the Important Support of 105.09”