Home / Forex news / USD/JPY Challenged by the Bears at 108.85

The US dollar versus the Japanese yen currency pair lost part of the gains made last week. Is this a bearish win or the bulls are preparing their new march towards 110.29 from better prices?

Long-term perspective

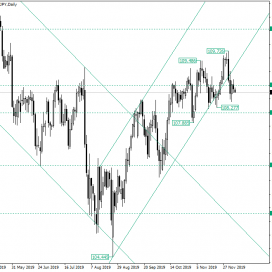

After the low printed at 104.44, the price started an appreciation that took the shape of an ascending trend.

The low of 108.27 posted a threat for the bullish advancement, but they were able to get the price back within the ascending channel and facilitate an upwards movement that topped at the 109.72 high.

From the 109.72 high the bears were very determined, and that was seen as the price pierced yet again the support trendline of the ascending channel and also the 108.85 level that last time was very easily conquered by the bulls.

However, the bulls showed that they are still in the market, as they crystalized a piercing pattern — see the December 4 and 5 candles, respectively. One amendment would be that the pattern was printed under the 108.85 level — the bullish candle closed at the level, not slightly above it which would have given the bulls even more credit.

The good news is that the piercing pattern, with respect to the low of 108.27, is a higher low, thus giving the bulls at least some confidence.

So, as long as the piercing pattern is not invalidated (in other words, as long as the low of December 5 is not taken out), the bulls still aim for 110.29, after 108.85 is reconquered.

Only if the price reaches the level of 108.13, then the situation will turn neutral.

Short-term perspective

After the bulls failed to turn the resistance of 109.19 into a support, the price dropped to 108.43, but the fact that the latter one withstand translates into the bulls still being in the loop.

The price is oscillating above the 108.43 supportive level. As long as this holds true, further appreciation is to be expected, 109.19 serving as the first target and, if confirmed as support, 109.99 follows next.

Only if 108.43 fails its supportive role, then 107.92 is exposed.

Levels to keep an eye on:

D1: 108.85 110.29 108.13

H4: 108.43 109.19 109.99 107.92

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “USD/JPY Challenged by the Bears at 108.85”