Home / Forex news / USD/JPY Confronting the 107.00 Resistance Level

The US dollar versus the Japanese yen currency pair seems to be willing to pass the 107.00 level. Will the bears defend it?

Long-term perspective

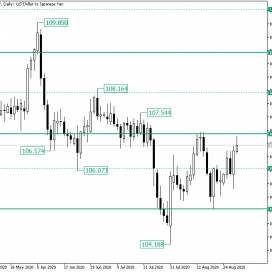

The fall from the 109.85 high extended until the 104.18 low. The high is part of a bullish overextension above the firm 109.00 level, while the low an overextension by the bears in relation to the major 105.09 level.

The decline from the peak to the bottom passed yet another area of interest, the psychological level of 107.00. So, these levels are the ones guiding the unfolding for the medium-term.

As from the 104.18 low, the price was able to extend until 107.00, throwback at 105.09, confirm 105.09 as support, and print another rise that stopped a hair away from 107.00, the bulls have reasons to consider that they are in charge.

However, noteworthy is that the psychological 107.00 level, as noted by the 107.54 high — alongside with the consolidation phase that pertains to it — and by the revalidation on August 13, is a resistance area.

Also, the overall shape of the movement — starting with the 109.85 high — is a descending one. Given these variables, the bears are the ones that sit in a comfortable position.

So, as long as 107.00 remains a valid resistance, the bears have 105.09 on their list. If the 106.12 level gives way, the path to 105.09 is shorter, whereas if it is taken by the bulls as another chance to define a rise, 105.09 may be delayed a little bit.

On the flip side, if 107.00 becomes support, then 108.05 is the first bullish target.

Short-term perspective

The appreciation from the 104.18 low extended until the 107.05 high. From there, the price fell until the 105.27 intermediary level, from where another rise was printed. This validated the ascending trendline.

So, as long as the double support etched by the ascending trendline and the firm 106.02 level remains valid, the bulls can print another higher high. This, in turn, opens the door to 107.34 and 108.02 later on.

However, if 106.77 holds as resistance, then the double support may cede, laying the path to 105.27 and, eventually, to 104.44.

Levels to keep an eye on:

D1: 107.00 106.12 105.09 108.05

H4: 107.34 108.02 106.77 106.02 105.27 104.40

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “USD/JPY Confronting the 107.00 Resistance Level”