Home / Forex news / USD/JPY Dropped from 111.70

The US dollar versus the Japanese yen currency pair stalled around the 112.00 psychological level. Is this only a correction?

Long-term perspective

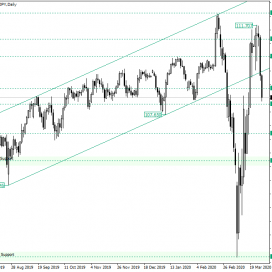

After confirming the monthly support of 101.18, the price rallied all the way up to the 111.07 level, peaking at the 111.70 high.

The rally also took the price back into the ascending channel, whose support trendline starts from the 104.44 low. This led to the bulls hoping that, after a corrective phase and as the price approaches the support trendline, they would get the chance to confirm it, yet again, and so to start a new movement towards the north.

However, what must be taken into consideration is that because the high of 111.70 is lower than the previous one, thus a lower high, the bulls must be very cautious. A first sign that indeed gives credit to the bears is that the candle on March 26, punctured the support trendline and followed by a steep decline.

So, unless the buyers are able to get the price back above the 110.29 support level — which would open the path to 112.25 — the profile can be considered as being bearish.

If the bulls succeed in establishing the price over the 108.85 level, then they might have a chance to aspire for 110.29. Noteworthy is that, for the time being, the area from 110.29 to 108.85 is neutral.

On the other hand, if the bears also clear the support of 108.13, then they can head for their next stop, 106.79.

Short-term perspective

The ascending trend that started from the low of 101.17 ended, as the price peaked at 111.72 and after a lower high — 111.68 — started a decline that pierced and departed from the support trendline.

After breaking the trendline, by departing, the price got nearer and nearer to the important support of 109.75. Even if the bulls tried to defend the level, the bears were too determined to let them stay in their way, so, in the end, the level was cleared, allowing further decline.

If the bulls manage to recuperate and bring the price back above the 109.75 level, then 110.22, 110.63, 111.01, and 112.16 are to be targeted. Otherwise, the next main bearish target is 105.68, with intermediary targets at 107.92 and 107.06.

Levels to keep an eye on:

D1: 108.85 110.29 112.25 108.13 106.79

H4: 109.75 110.22 110.63 111.01 112.16 105.68 107.92 107.06

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “USD/JPY Dropped from 111.70”