Home / Forex news / USD/JPY in Orbit â At 112.25. What Now?

The US dollar versus the Japanese yen currency pair skyrocketed. So, what goes up must come down or it this just the beginning of a new path?

Long-term perspective

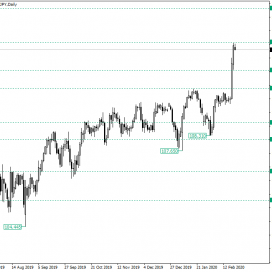

The low at 104.44 was the starting point for an ascending trend that, after extending until 110.29, gave signs of a possible turn around.

However, the consolidation that came about after the rally from 108.31 gathered sufficient energy to cause the explosive appreciation enclosed on February 19 and 20, respectively.

The power of the bulls was so overwhelming that the next major resistance, the level of 111.07, was passed like it was not there, the only aspect of the appreciation that considered it being the low on February 20, which used it almost like a springboard to further gain advancement.

Even if for the time being the best approach is to let the situation cool off a bit, so that consolidations are given the chance to build up, possible scenarios are relatively easy to be glimpsed.

So, the first one allows a short-term consolidation to form, something like a pennant or a flag. As they are continuation patterns and as they would be preceded by a rally, the expectations are to facilitate the piercing of 112.25. This should clear the way towards 113.68 — until there, the psychological level of 113.00, which is not highlighted on the chart, may also serve as a profit booking area.

The second scenario deals with the confirmation of 112.25 as resistance. This may come after a false piercing or simply as a strong bearish candlestick pattern, such a dark cloud cover. Such development targets 111.07.

Short-term perspective

After confirming the level of 108.43, the price appreciated, then consolidated, and appreciated again, reaching the level of 112.16.

After a relatively short-term consolidation, the price could pierce 112.16, heading for 112.91.

On the other hand, if 112.16 holds — or if it only falsely pierced or if 112.91 catalyzes a depreciation that strong so that the price goes back beneath 112.16, respectively — the support level of 111.01 is the next destination.

Levels to keep an eye on:

D1: 112.25 113.68 111.07

H4: 112.16 112.91 111.01

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “USD/JPY in Orbit â At 112.25. What Now?”