Home / Forex news / USD/JPY Might Correct Before Further Appreciation

The US dollar versus the Japanese yen currency pair is at a point in which it should draw a correction, otherwise it might be considered that it is overextending.

Long-term perspective

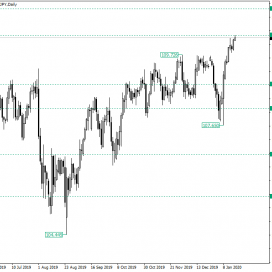

After falsely piercing the level of 105.55 and printing the 104.44 low, the price began an upwards pointing trend.

But beginning with December 2019, the bulls were challenged, as the price began to have a hard time gaining any advancement.

This culminated with the strong depreciation that almost succeeded in establishing the price under 108.13. However, the bulls strongly entered the scene and, besides printing the low of 107.65, which in turn rendered the piercing of 108.13 as a false one, effected an appreciation that took out the previous highs — note 109.72 — and also extended until the 110.29 resistance level.

On January 14, the bears tried to defend the level by printing a shooting star. But the bulls kept that in check, as not only that they did not allow any depreciation, but invalidated the shooting star via the bullish candle on January 16, and the oscillation of the next one above its high.

From the current state, the situation could evolve in the following ways. First, a consolidation phase can materialize, one limited by the resistance of 110.29 and the support that results from the low of the January 16, candle. This phase would be purposed in facilitating the conquering of 110.29.

The second scenario is for the price to pierce 110.29 and confirm it as support, either with a throwback or by printing a consolidation structure, like a flag or a small range.

These two scenarios open the door to 111.07, which is the first profit taking area. Only if the price falls back under 109.72, then the price might revisit 108.85.

Short-term perspective

After confirming 107.92 as support, the price began an appreciation that took the price above 109.75. If the price succeeds to confirm the level as support, either by confirming it for at least one more time or by a false piercing, then 110.63 is to be reached, followed by 111.01.

On the other hand, if the price fails to confirm 109.75 as support, then 109.19 is a target and it may be followed by 108.43.

Levels to keep an eye on:

D1: 110.29 111.07 108.85

H4: 109.75 110.63 111.01 109.19 108.43

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “USD/JPY Might Correct Before Further Appreciation”