Home / Forex news / USD/JPY rallies to key resistance amid ongoing risk ON trade

It has been “risk-on” at start of the new week so far, with global stocks and crude oil rallying and safe-haven yen falling. Sentiment has remained supported by positive signals around US-China trade negotiations, while concerns over an economic slowdown have eased following the release of some above-forecast macro data of late. But with the past weakness in data and not a brilliant corporate earnings season, it remains to be seen how much further trade-related optimism support will Wall Street, and risk assets will in general, going forward. For now, investors don’t seem to be too concerned judging by the Wall Street rally and crushing of the VIX, the so-called fear index.

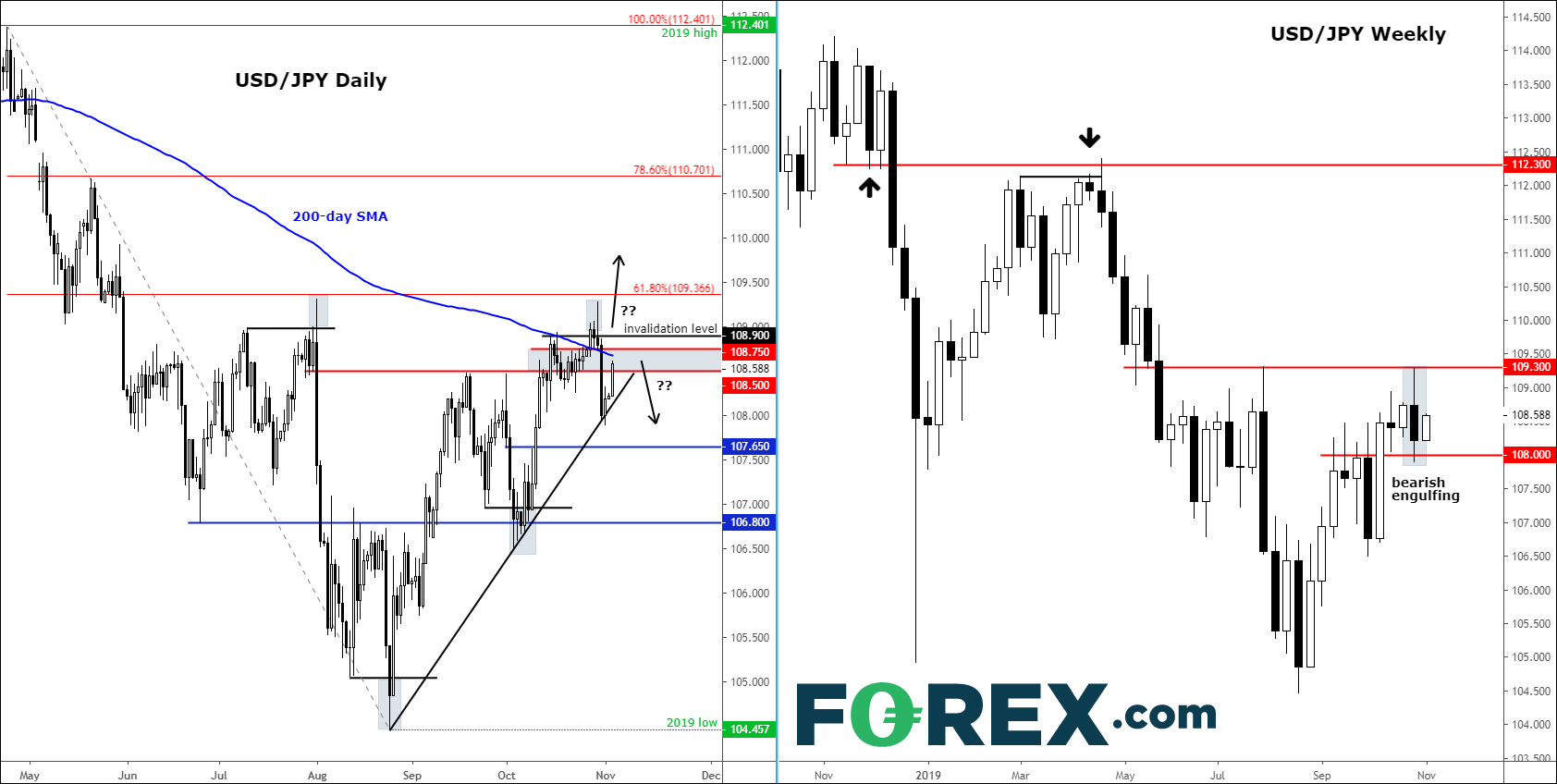

In FX, too, the underlying theme up until now has been “risk-on.” The USD/JPY, for one, has bounced back following last week’s sell-off. However, it remains to be seen whether it will go back and hold above the resistance zone around the 108.50-75 area. What happens here could be important, at least from a short-term technical point of view, anyway. With the recent rally running out of juice and rates falling back below the 200-day average, the bears might step back in around this 108.50-75 former support zone. However, if the US equity markets are anything to go by then the USD/JPY might be able to regain its poise.

So, as the bulls and bears battle it out, we are on the lookout for a clearer picture to emerge before deciding on the direction. But given the failed breakout attempt, and the recent weakness for the Dollar Index, we are leaning more towards the bearish than bullish view here.

Source: Trading View and FOREX.com.

Original from: www.forex.com

No Comments on “USD/JPY rallies to key resistance amid ongoing risk ON trade”