Home / Forex news / USD/JPY Respecting the 105.09 Support?

The United States dollar versus the Japanese yen currency pair seems to be under bullish control.

Long-term perspective

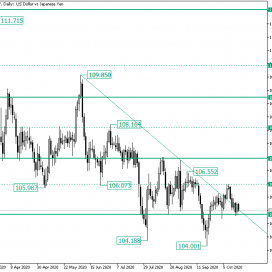

From the 111.71 high, the price started a decline that, for the time being, coined the low at 104.00.

Along this path, the market crystallized two unfoldings that are trying to emulate ranges. The first one is limited by the 109.08 and 107.00 firm resistance and support, respectively.

The second is lined up by 107.00 as resistance and 105.09 as support. Both ranges are aligned in such way that — from the 109.85 high — the market appears to be in a downtrend.

However, the bulls are attempting a comeback, as from the 104.00 low they were able to drive the price to the 106.12 intermediate level, piercing the descending trendline in the process.

Furthermore, the decline on the 14th of October was limited by the 105.09 level, the same one which fueled the appreciation from the 104.00 low, serving as a support area that allowed the bulls to continue their march and pierce the descending trendline.

So, as long as the price sits above the double support defined by the 105.09 firm level and the descending trendline that starts from the 109.85 high, the bulls could continue their journey to 106.12, which, if conquered, opens the door to 107.00.

On the other hand, if the market resumes being inside the falling trend, the 104.00 psychological level — not highlighted on the chart — could be a first bearish stop.

Short-term perspective

From the 106.26 high, the market extended until the 104.00 low, from where — after a short period of appreciation — it started a range which sits on the 105.27 intermediary level and is kept in check by the 106.02 resistance.

From the 105.79 high, the price attempted to draw a descending trend, thus continuing — in a more oscillative fashion — the fall from the 106.10 high.

But as the intermediary level of 105.27 — which, alongside the upper line of the descending channel, could have served as a double resistance area — failed the bears, the bulls are attempting a takeover.

So, as long as 105.27 remains support, the bulls can eye 106.02. On the flip side, if the price returns under the aforementioned double resistance area and confirms it, then 104.44 is the next bearish objective.

Levels to keep an eye on:

D1: 109.85 106.12 107.00 104.00

H4: 105.27 106.02 104.44

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “USD/JPY Respecting the 105.09 Support?”