Home / Forex news / USD/JPY Resuming the Fall from 105.67?

The US dollar versus the Japanese Jen currency pair seems to have lost its steam. Are the bears just around the corner?

Long-term perspective

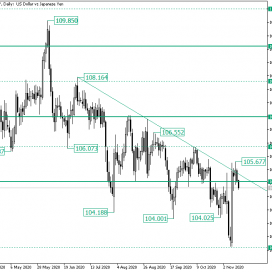

The high of 109.85 is the start of a drop that extended until the intermediary level of 103.15.

Along this path, the bulls attempted several recoveries, but, as it can be seen from the string of lower highs and lower lows, they all ended as new bearish opportunities.

However, the last low, 104.02, was a higher low compared to the previous one at 104.00. This sparked bullish hopes, as, on November 4, the price visited the area above the firm level of 105.09.

But what followed was a sharp decline, one that sent the price a hair away from 103.15.

Still, the bulls pulled the ace off their sleeves and projected the price above 105.09, piercing the descending line that starts from the 108.16 high, as the high of 105.67 highlights.

Nevertheless, the 105.67 high could end up being just a false piercing, as the price did not gain momentum towards the north.

So, as long as 105.09 serves as support, the bulls could try new appreciations that target 106.12, but as long as de descending trendline limits any bullish advancement, the level may turn resistance.

On the other hand, as the price simply slipped under 105.09, the bears could have already settled a clear path towards 103.15, with 104.00 — not highlighted on the chart — as an intermediary profit booking area.

Short-term perspective

After printing the high of 105.34, the price dropped under the lower line of the descending channel, stopping very close to the 103.09 intermediary level.

The rally that came about fueled the bullish hopes that they could send the price above the upper line of the channel, this being a first step of the plan to conquer 106.03.

However, after succeeding to pierce the channel, they got stopped in their tracks by the 105.27 level.

If they cannot win 105.27, then the price would be sent to 104.44. On the other hand, if they seize the situation, then they can hope for 106.02.

Levels to keep an eye on:

D1: 105.09 106.12 103.15

H4: 105.27 104.44 106.02

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “USD/JPY Resuming the Fall from 105.67?”