Home / Forex news / USD/JPY Still to Tumble from 105.55?

The US dollar pound versus the Japanese yen currency pair continued the movement towards the south. Are there any chances for a pause?

Long-term perspective

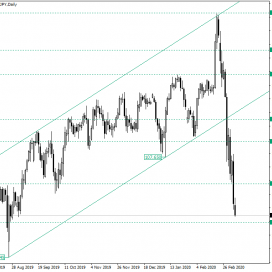

The ascending trend that started from the low of 104.44 extended until the resistance level of 112.25. From there, after confirming the double resistance made possible by the upper line of the channel and the 112.25 level, the price started a depreciation.

What initially seemed to be a corrective wave, that was expected to end around the lower boundary of the ascending channel, turned out to become a very strong fall, one that pierced not only the support of the channel, but also other three important support levels: 108.85, 108.13, and 108.79.

As the bears approach the next level, 105.55, respectively, one of the two possible — and logical — scenarios may come into being.

In the first one, the bulls counteract. This could lead to a trend reversal chart pattern — such as a double or triple bottom — or even to one or more false piercings. Of course, a combination between them, like say two false breaks of 105.55 that form a double bottom, cannot be ruled out.

The second scenario stays true to the bears, aiding them with the puncture of this support level as well. But in this case, the low of 104.44, which highlights a very important area from the weekly perspective, may oppose further advancement.

The aim for the case in which the bears cannot extend further away from 104.44 — and also for the first scenario — is represented by the 106.79 level.

Short-term perspective

The descending movement from 112.22 is still active, being very close to the next support, 105.68 respectively.

If 105.66 facilitates a retracement, then the gain could reach 107.06. On the other hand, if the price only consolidates, irrespective of whether it takes place above or under the level, then further decline is in the cards, with the 105.00 psychological level — not highlighted on the chart — as the main target.

Or course, such a strong depreciation requires some time to decelerate. As the investors are keeping high demands for safe heaven currencies amid the coronavirus outbreak, refuge financial instruments — like the Japanese yen — have the necessary context to thrive.

Levels to keep an eye on:

D1: 105.55 106.79 and the low of 104.44

H4: 105.66 105.00

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “USD/JPY Still to Tumble from 105.55?”