Home / Forex news / USD/JPY Topping at the 109.70 Area?

The US dollar versus the Japanese yen currency pair seems to have some trouble climbing to new highs. Is it so or is it just pausing?

Long-term perspective

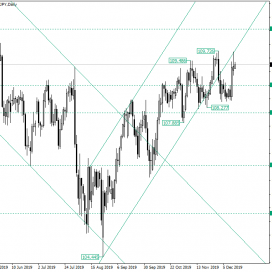

Although the trend from 104.44 seems to have ended, as the support trendline of the channel was pierced, the ascending movement itself did not, at least for the time being.

The first reason for such a view can be ascribed to the fact that the area from were the strong bullish candle started — on December 12 — is a higher low with respect to the previous low of 108.27.

An important addition is that 109.72 is a higher high if compared to the previous high of 109.48. So, given that the last lows and highs, respectively, are higher than the ones that precede them, the message is clear: the profile is — still — bullish.

One amendment could be that on December 13, the market was not able to print a higher high, concerning 109.72. However, the current ascending swing did not yet ended, as the fact that the price strongly retraced from the lower line of the ascending channel — thus confirming it as a resistance — does not count as the end of the impulsive wave, but as a profit-booking phase from the bullish side, one that can easily be followed by another upwards pointing leg.

As a consequence, one possibility is for a short-lived consolidation phase to take place. After it, the ascending movement can continue its march towards 110.29, which is the main target.

Another possibility is to assist at a retracement to the 108.85 level, a place where the bulls can join the market at a better price. This could delay the advancement to the north, as the bears might think that they have a chance. The bears can say that they were actually able to postpone the appreciation only if they reach the 108.13 area, a situation in which the profile turns neutral.

Short-term perspective

The appreciation that started after 108.43 was confirmed as support conquered the 109.19 level. As long as the price oscillates above it, the path to 109.99 is open.

If the bears manage to push the price under 109.19, then 108.43 becomes the main target. From there, appreciations to 109.19 and, later on, 109.99 are to be expected.

Only if the price gets beneath 108.43, then the bears could extend until 107.92.

Levels to keep an eye on:

D1: 110.29 108.85 108.13

H4: 109.19 109.99 108.43 107.92

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “USD/JPY Topping at the 109.70 Area?”