Home / Forex news / USD/PLN: Will EM currencies find support from US-China trade optimism?

Although optimism over a phase-one US-China trade deal has fuelled a rally in US equities and to a lesser degree European markets, emerging markets (EM) and their currencies have lagged well behind.

However, EM currencies could catch up if the world’s largest economies manage to strike a phase one trade deal eventually or optimism grows further that an agreement is imminent.

The flip side is that a bearish catalyst could weigh heavily on the already under-performing EM assets.

But for now, there seems to be more positive than negative news regarding US-China trade and the markets have been rising more than they have been falling. So, I am giving the bulls the benefit of the doubt until told otherwise by price action.

One of the EM currencies catching my eyes in the Polish zloty. The zloty has been performing better than the likes of Turkish Lira of late, although not as well as the Russian ruble. At last check, PLN was down just 3.5% year-to-date against the dollar, while TRY was 7.7% worse off. However, RUB was up more than 7.5% YTD.

Still, recent price action has been bullish on not just the zloty but a number of other emerging market currencies too, suggesting the worst is behind us.

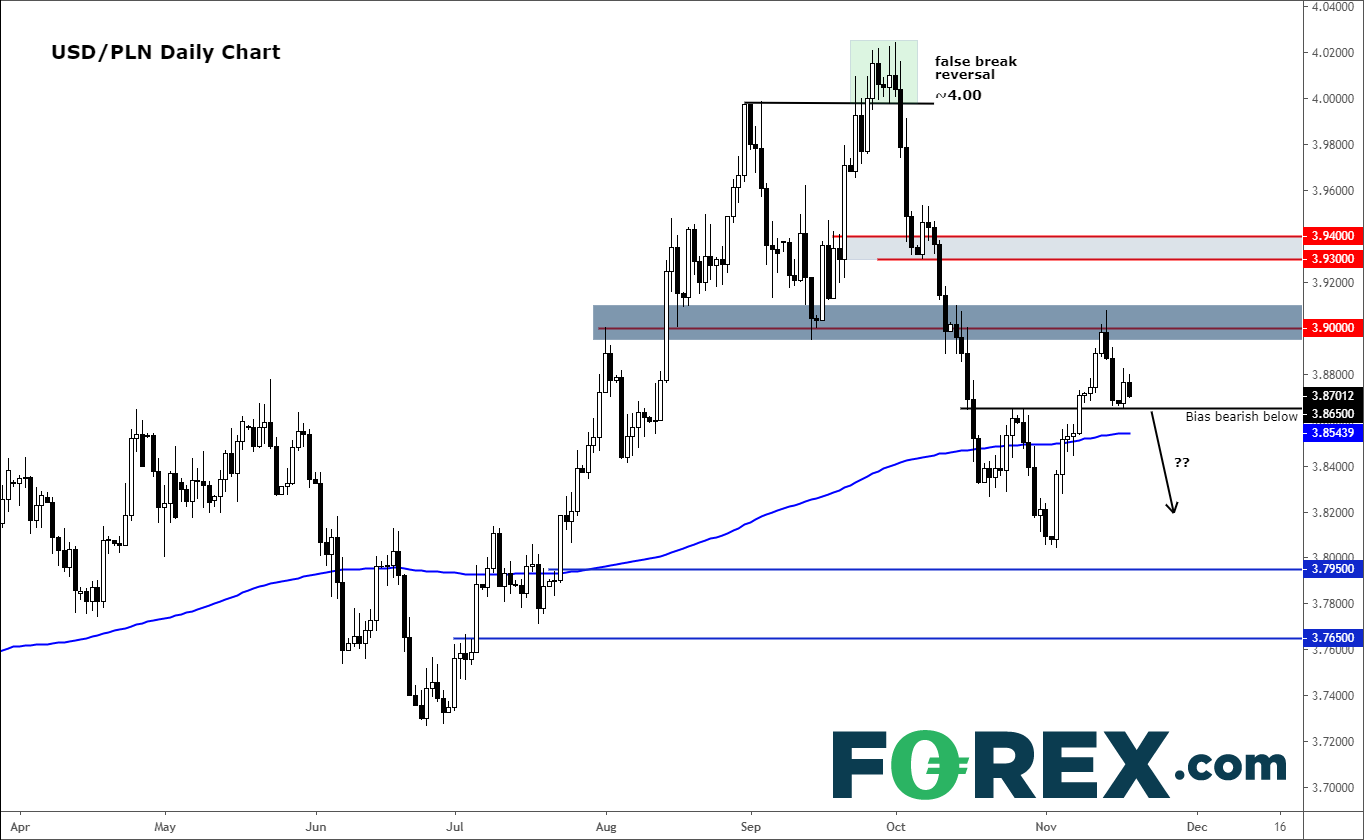

In fact, the USD/PLN may have already topped out when the rally above the old high and psychologically-important 4.00 hurdle failed to hold towards the end of September and early October. From there, rates have fallen sharply until bottoming out earlier this month around 3.8050:

Source: Trading View and FOREX.com.

Looking at the chart and and a new downward move may have started again since Thursday of last week. That’s when rates hit key resistance in the 3.90 region, which was the last low prior to that failed rally above 4.00. Once a key support level, this has turned into resistance.

The sizeable drop from around 3.90 we saw in the last two days of last week has me wondering whether there are more losses to come.

For now, the USD/PLN has found some mild support from old resistance circa 3.8650. If this level were to break down, then this could potentially pave the way for more losses in the days ahead.

So, the key level to watch for a potential breakdown on the USD/PLN is at 3.8650.

Original from: www.forex.com

No Comments on “USD/PLN: Will EM currencies find support from US-China trade optimism?”