Home / Forex news / Wedge Chart Pattern on AUD/USD Played Out?

The Australian dollar versus the United States dollar currency pair seems to have failed in any further appreciation attempts. Is this the entire story?

Long-term perspective

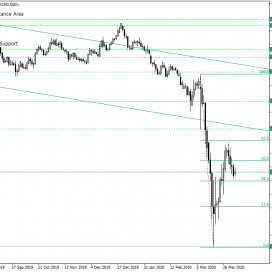

After confirming the resistance area defined by the 0.7055 and 0.7013 levels, the price began a depreciation that unleashed until the 0.5511 support level. From there, the price retraced above the 0.6015 level and extended two thirds away from the possible double resistance area made possible by the lower line of the channel and the level of 0.6313.

The price then commenced yet another retracement, this time 0.6015 being the possible target. But is this an actual throwback or not? In other words, the bulls should expect this area to serve as support, or the market is already displaying a bearish victory?

Considering that the price almost touched the 61.8 Fibonacci retracement level and started descending, it is likely that this fall is in fact a continuation of what began at the 0.7013 level. So, unless the price is closing a day above 0.6015, the profile may very well be a bearish one targeting the 23.6 retracement level (which corresponds to the 0.5800 psychological level) and then 0.5511.

On the other hand, if the bulls take hold of the situation, then the level of 0.6313 is the next target. Noteworthy is that, for such a scenario, the 61.8 retracement level is a partial target.

Short-term perspective

The drop from 0.6684 formed a wedge that led to a modest depreciation. This might be because the level of 0.5967 might be seen by the bulls as their potential springboard, and because of this, they are trying to slow the descent so that they won’t miss it.

If they don’t, a confirmation of 0.5967 could bring a rally that reaches the 0.6231 level. But even if the price gets under the level, as long as the bulls manage to halt the depreciation before or above the low of 0.5869, the price has the potential to head back for 0.5967 and from there above it and towards 0.6231. But if the price stops at 0.5967 or if it cannot establish itself above it, then 0.5666 is the next stop.

Levels to keep an eye on:

D1: 0.6015 0.5511 0.6313 and the Fibonacci retracement projections of 38.2 23.6 61.8

H4: 0.5967 0.6231 0.5666

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Wedge Chart Pattern on AUD/USD Played Out?”