Home / Forex news / Will the 105.09 Support Hold?

The United States dollar versus the Japanese yen currency pair seems to have lost its steam after a very strong appreciation. Was that all the bulls could do?

Long-term perspective

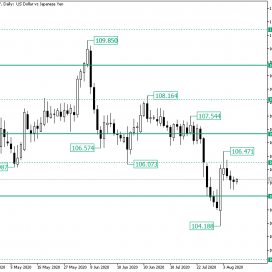

The fall from the 109.85 high, which is part of the false piercing of the firm 109.00 resistance level, managed to extend until the 106.12 intermediary level. The latter served as support, propelling the price back above 107.00, another steady level that was pierced during the substantial fall from 109.85.

However, the extension was halted by the 108.05 intermediary level, which caused a pullback followed by a consolidation phase. The peak of the consolidation phase is marked by 107.54 and was followed, three days later, by the second fall, spreading until the 104.18 low.

To be noted that 104.18 is well under the 105.09 consistent support level. Despite the odds, the bulls printed a robust appreciation, one that got the price above 105.09 and sent it to the 106.12 supportive intermediary level. But this time it appears that the level was not able to help the bulls, as it did when it facilitated the printing of the 106.07 low. Instead, it etched the 106.47 high and sent the price beneath the area it defines.

But as long as the price oscillates above the 105.09 level, the bulls can perform a comeback. But even if they pull it off, as long as they are not able to reconquer 106.12, they would only carry the bears’ water, as they will offer them better prices to short from. Nevertheless, if they capture 106.12, then they could eye 107.00, for the time being. On the other hand, if 105.09 gives way, then the bears could drive the price to 103.15.

Short-term perspective

After the drop from 107.22, which led the price to the 104.17 low, the bulls mounted a counteroffensive, which brought the price ar the area of the 106.00 psychological level.

One possibility, if for the 105.27 and 106.02 to bound the price, causing a range movement. But if 105.27 cedes, then 104.44 may be an easy peak for the bears.

Levels to keep an eye on:

D1: 105.09 106.12 107.00 103.15

H4: 106.00 105.27 104.44

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Will the 105.09 Support Hold?”