CMC Markets Review

CMC Markets is an experienced broker and the world’s leading betting provider with a wide range of trading products. The company is registered in the UK; its branches are located in Australia, New Zealand, Singapore, Spain, Germany, France and other countries.

Accounts and Commissions

The broker is controlled by FCA, NFA, BAFIN, OSC and other regulators. CMC Markets pays special attention to the development of new technologies to increase trade efficiency and customer experience. Broker provides accurate quotes, prompt execution and favorable terms for trading.

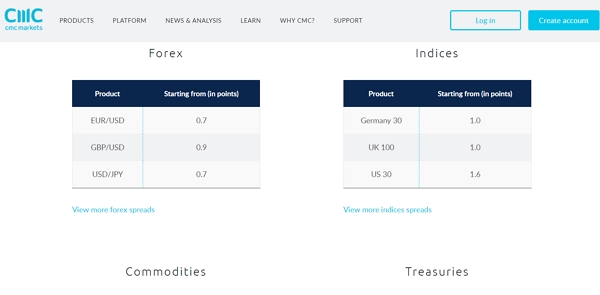

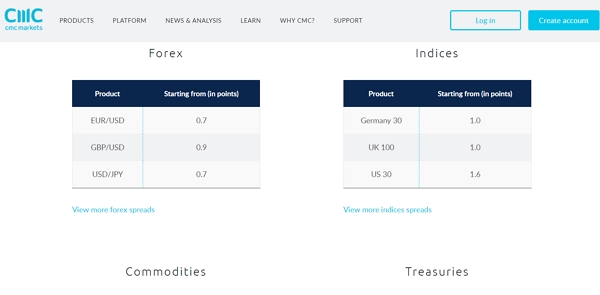

There are three types of accounts: a demo account, a CFD account, and a spread betting account. To open a standard account, a trader will need 100 USD. Traders can use the maximum leverage of 1: 100, the spread on the principal currency pairs is fixed from 2 points. In addition to currency trading, customers can opt for additional financial instruments like shares, indices, and commodities. All new customers get a free demo account to test a new strategy.

CMC Markets also provides analytics of experts on financial markets, comments and forecasts for currency pairs, technical and fundamental analysis. To stay in touch, traders can look through the news from Reuters and the economic calendar for the week.

Trading Platforms

The broker offers the following convenient and easy-to-use platforms: CFD Platform, Spread Betting Platform and MT4. CMC Markets supports hedging and scalping.

MetaTrader 4 is a wide spread trading platform which combines modern analytical and trading technologies. Due to its accessibility and great functionality, most traders worldwide choose this software. It is used by both professionals and beginners. Its tools include two market orders,

three modes of order execution, four pending orders, tick chart, quotes history, etc. Traders analyze data using interactive graphics, graphical analysis tools, various timeframes, numerous technical indicators, access to a free database of customized indicators and strategies, etc.

The broker’s mobile apps for iOS and Android offer advanced charting, intuitive layouts, pending order execution alerts and allows using more than 30 technical indicators. CMC Markets also provides for trading guides, Forex and CFD trading.

Characteristics

- Automated dealing desk

- Financial regulators are

- Extensive experience in various financial markets

- A wide range of trading tools

- Ability to engage in automated trading

- Qualified analytical support