Core Spreads Review

Core Spreads is a brokerage company, which offers competitive terms. Its main feature is low, fixed spreads. The company is registered in London. Its activity is regulated by FSA.

How to open an account

In order to do that, you should fill in the registration form, which requires such information:

- Full name;

- phone number;

- e-mail;

- country;

- password;

Send this information, and follow further instructions, that will appear on the screen.

Competitive terms

Core Spreads offers rather favourable trading conditions:

- min deposit — 1 USD;

- min lot — 0,01;

- leverage — 1:200;

- spread — 0,3 points.

- scalping — available;

- hedging — allowed.

Types of accounts

The company offers 2 variants:

- Core Trader;

- Core MT4.

They differ only in platform. All the other conditions are the same — they are described previously in this article.

Demo account

This one makes it possible to try trading with virtual money. All the quotations, functions and trading instruments are identical to real. It gives an opportunity to beginners to try themselves and to experienced traders — to try new strategies, to test indicators and so on.

Platforms

There are 2 of them:

- MetaTrader 4 — is a classical famous terminal, which has a rich functional, user friendly interface, and a big choice of instruments and indicators.

- CoreTrader — is an own platform created by Core Spreads. It differs in functional a bit, but in general it is not worse, than well-known MT4.

Instruments

Core Spreads gives to clients a wide choise of instruments:

- currency pairs (major and minor);

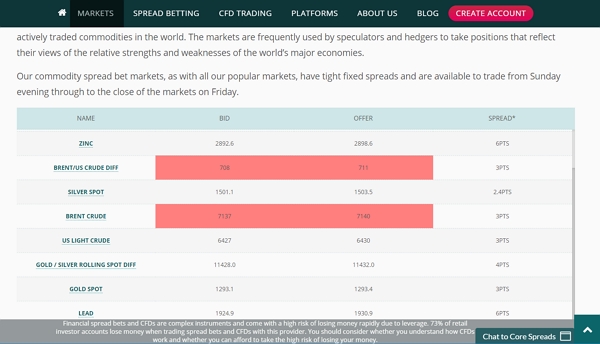

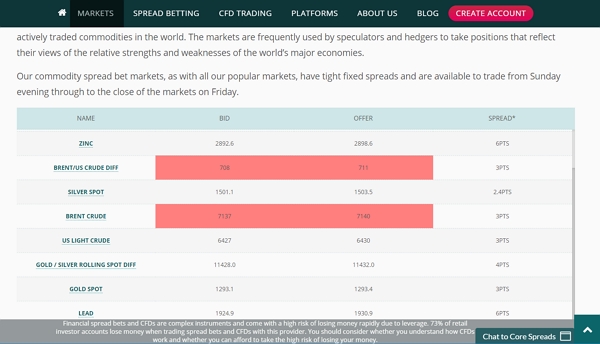

- gold and other metals;

- stock indices;

- CFDs;

The most demanded are Forex actives, because they are not very volatile, and they are easier to be technically or fundamentally analized.

Support

You can call the number mentioned on the website 24 hours 5 days a week (Sunday 10 p.m. — Friday 10 p.m. by London time). Also you can contact a support manager by e-mail.

Analysis

There are no articles with serious analytical material. Also there are no instruments, such as economic calendar, trader’s calculator and so on. But there is a section on the website called «David Buik Commentary». It contains videos, in which an experienced financial analytic shares his opinion on a certain topic, makes a reviews of financial news and gives some forecasts.

Education

There is an educational sector on the website, but it is rather introductory, than really educational.

Advantages

They are:

- competitive spreads

- convenient platforms;

- low min deposit.

Disadvantages

They are:

- abscence of instruments for analysis;

lack of educational materials.