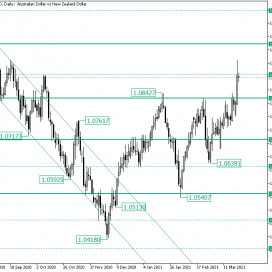

Home / Forex news / Bears to Take Over AUD/NZD After Rally Above 1.0895?

The Australian versus the New Zealand dollar currency pair printed a rally that might be just too tempting for the bears. Or isn’t it so?

Long-term perspective

After the inverse head and shoulders pattern — that sits under the neckline of 1.0551 — spawned the rally to the firm area of 1.0707, the price retraced to the 1.0631 intermediary level.

Validating 1.0631 translated into another appreciation, one that noted the 1.0842 high. However, as the high formed just above the heavily bearish defended area of 1.0826, the sellers joined the market, sending the price under 1.0707 and back to 1.0551.

From there, the bulls drew a rally anew but stopped at the same 1.0826 resistance area, from where the bears — yet again — caused the price to ebb to the 1.0639 low.

As the 1.0639 low was a higher high with respect to 1.0540, the bulls kept their fate a made another attempt to check 1.0826 — which they did, after validating 1.0707 as support.

The determined climbing succeeded in setting the price above 1.0895. How the bears will react is very important. So, if the price slips under 1.0895, then it can be considered that the level has been falsely pierced, and 1.0826 is the next target under bearish charge.

On the flip side, if 1.0895 becomes support, then 1.0936 is the main bullish objective.

Short-term perspective

Following the decline from 1.0827, the price rotated at 1.9639, and commenced to climb until reaching the 1.0820 level. What initially looked to be a false piercing of 1.0820, as the price marked the 1.0840 high and retraced to the intermediary level of 1.0778, proved to be a bullish success.

One possible scenario is for the price to print a throwback to 1.0866, from where the rise would target 1.0921 first and 1.0987 later on. Still, if the price fails to find support at the 1.0921 level, the second scenario is for the movement towards 1.0820 to be likely just a matter of time.

Levels to keep an eye on:

D1: 1.0895 1.0895 1.0936

H4: 1.0866 1.0921 1.0987 1.0820

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Bears to Take Over AUD/NZD After Rally Above 1.0895?”