Home / Forex news / Bears Trying to Get Hold of USD/JPY from 109.08?

The United States dollar versus the Japanese yen currency pair seems to have hit a resistance area. Do the bulls still have enough power to overcome it?

Long-term perspective

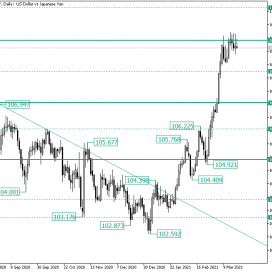

After printing the low of 102.59, the price retraced as if it was going to note on the chart yet another correction, as it did on the previous occasions.

Still, as the high of 104.39 was not able to spark a convincing decline, defining an angled rectangle instead, the price went north.

On the first run, it pierced 105.09, but the bears attempted to keep the bulls in check by marking a fall. To their revulsion, the bulls climbed the price back — an even further, to the 106.12 intermediary level, where they printed the 106.22 high.

The bears reloaded and went for another depreciation. But to their astonishment, the plan went south only for them, for the bulls validated 105.09 as support, and from the 104.92 low, they have extended a rally that touched the firm area of 109.08.

Upon the arrival at 109.08, the bulls were met by a robust rejection. Still, they managed a second run, which means that they have — at least — the desire not to let go.

So, as long as the price consolidates under 109.08, chances are that the level may cede, allowing further advancement towards the 110.18 intermediary level.

On the other hand, if the bulls accomplish to set the price above 109.08, but then the bears turn it back, 108.05 may be paid a visit.

Short-term perspective

From the 104.92 low, the bulls started a sustained appreciation, one that pierced main and intermediary levels alike.

Nevertheless, the 109.27 resistance seems — at least for the time being — unpenetrable. Still, as the chart notes higher lows — see 108.35 and 108.62, respectively — it can be considered that the bulls still have a chance.

So, as long as 108.53 remains support, 109.27 could become support as well. If that happens, then 109.66 is the next bullish objective.

On the flip side, if 108.53 gives way, then the fall could meet 108.02. If the latter holds, then range trading is in the cards. If not, 107.34 and 106.77 are bearish targets.

Levels to keep an eye on:

D1: 109.08 110.18 108.05

H4: 108.53 109.27 109.66 108.02 107.34 106.77

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Bears Trying to Get Hold of USD/JPY from 109.08?”