Home / Forex news / Bulls Attempting to Check 109.08 on USD/JPY

The United States dollar versus the Japanese yen currency pair seems to be aided by the bulls’ will to drive it higher.

Long-term perspective

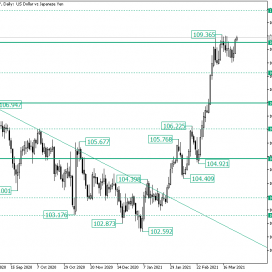

The 102.59 low marked the turning point that led to the dismal of the double resistance area marked by the falling trendline alongside the 103.78 intermediary level. Following its piercing, the price climbed until the 105.09 level — where the bears tried to maintain their market dominance.

On the second endeavor, the bulls secured the 105.09 firm area. This led to a sustained rally that sent the price to the 109.08 level. Under this zone, the price commenced forming a consolidation phase. During this, the 109.36 high was engraved on the chart.

Even if, initially, the 109.36 high could have been considered a failed bullish attempt, the fact that the resulting fall was short-lived and spawned an appreciation back to the 109.08 level is a sign of bullish strength.

If the bulls succeed in checking 109.08 as support, then they can head for their next objective — the 110.10 intermediary level. Even if 109.08 is not immediately validated by the bulls, as long as the 108.85 level serves the buyers, new attempts to conquer 109.08 are in the cards. Only if 108.85 cedes, then 107.00 is exposed.

Short-term perspective

The 104.98 low marked the start of a rally that extended until the 109.27 area. Limited by 109.27 and 108.53, the flat oscillates in the wait of one of the boundaries to give way.

However, as the two false piercings — marked by the 108.35 and 108.40 lows, respectively — and as the “lazy” retracement from the 109.27 level to the 108.40 low was followed by a convincing rally, the bulls receive the credit.

So, if 109.27 is passed, 109.66 is the first target, while 110.21 is the second. If the situation goes the other way, then 108.02 is the main bearish objective.

Levels to keep an eye on:

D1: 109.08 110.10 108.85 107.00

H4: 109.27 109.66 110.21 108.02

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.

Original from: www.earnforex.com

No Comments on “Bulls Attempting to Check 109.08 on USD/JPY”