Home / Forex news / Fed Recap: ‘Some’what Dovish Hike Not Enough for Stocks

Heading into arguably the last major market event of 2018, traders felt they had a decent grasp on what the Federal Reserve would do.

Despite a wobble in financial markets and rising global concerns over the last few months, delaying the long-telegraphed interest rate increase would likely do more harm than good, as we noted in our numerous Fed preview reports. That said, with fears of a global economic slowdown in 2019 on the rise and the yield curve nearing inversion, traders expected a so-called “dovish hike,” with Powell and company emphasizing that future monetary policy decisions would be heavily data dependent, with the potential for a substantial pause in the rate hike cycle if the US economy turned south.

In other words, the market pretty much nailed it:

1) The Interest Rate Decision and Statement

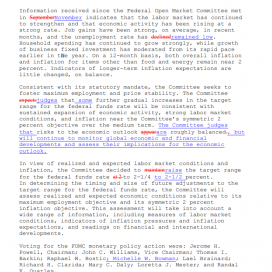

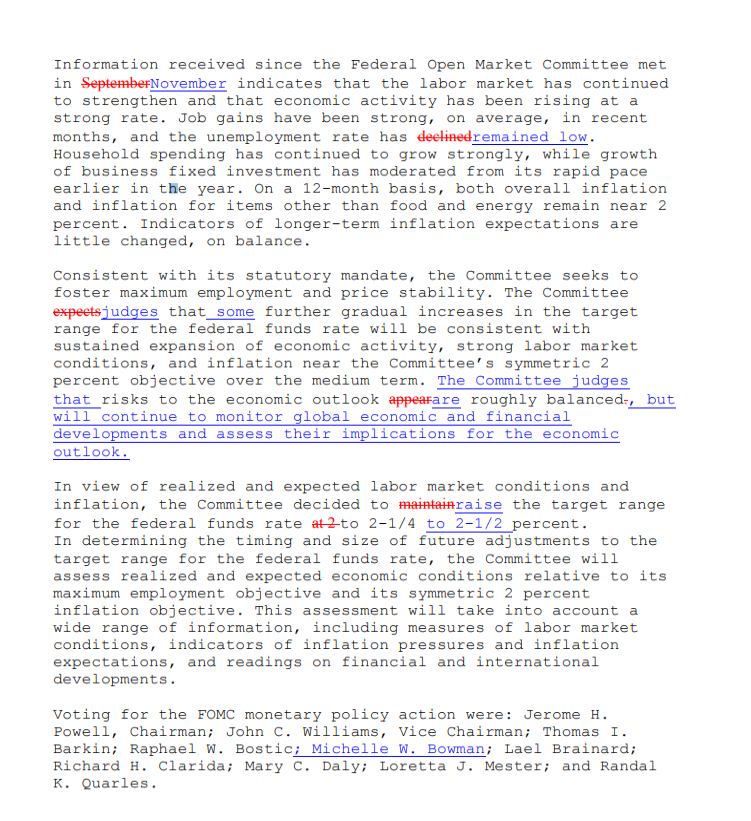

As widely expected, the Fed raised interest rates by 25bps to the 2.25-2.50% range, marking the 9th such interest rate increase since the Fed left zero interest rate policy (ZIRP) behind in December 2015. The decision to raise interest rates was unanimous (perhaps on-the-fence voters opted to show solidarity with Chairman Powell rather than be seen bending to political pressure?).

That said, the central bank did make some (slight) dovish tweaks to its monetary policy statement. Policymakers reiterated that the risks to the economic outlook were “roughly balanced,” but did add a clause about continuing to “monitor global economic and financial developments and assess[ing] their implications for the economic outlook.” The central bank also updated its forward outlook, noting that “some further gradual increases” in interest rates are expected. Many analysts expected Powell and Company to remove the “further gradual increases” wording entirely, so while this is a marginal dovish shift, it may be less dovish than traders were anticipating.

Source: FOREX.com

2) The Summary of Economic Projections

There were a couple of notable tweaks to the Fed’s quarterly economic forecasts. Most importantly, five of the potential Fed voters revised their 2019 interest rate forecasts lower, meaning that the median policymaker now expects just two rate hikes in 2019 (down from three at the September meeting). Now, the majority of Fed members (11/17) expect two or fewer interest rate increases next year.

On a macroeconomic front, the median Fed member’s forecast generally reflected a more cautious outlook for the economy in 2019:

Finally, the longer run so-called “neutral” Fed Funds rate estimate dropped from 3.0 to 2.8%, suggesting that the median Fed member thinks we’re within two rate increases of a neutral level.

3) Fed Chair Powell’s Press Conference

Jerome Powell is still taking questions as we go to press, but so far his comments have reinforced the slight dovish tone of the statement and economic projections. He’s emphasized international crosswinds, tame inflation, and market volatility as possible risks, but noted that recent developments have not fundamentally altered the central bank’s outlook.

Powell also noted that the central bank has now reached the bottom end of estimates of the neutral interest rate, meaning the Fed will be more data-dependent than ever moving forward. Finally, the Fed Chairman expressed no concerns with the central bank’s “balance sheet runoff” (Trump’s so-called “50 B’s”), suggesting that the Fed will continue to tighten policy through asset holding reductions.

Market Reaction

As I speculated on twitter this morning, today’s “dovish hike” was not quite as dovish as many traders were expecting. As a result, we’ve seen the US dollar index bounce back 50 pips to trade back in positive territory on the day, while the S&P 500 has dropped 3% off its intraday peak to its lowest level since last September. A close here would mark a significant break below support in the 2530 range, potentially opening the door for further downside heading into the typically low liquidity holiday period.

Original from: www.forex.com

No Comments on “Fed Recap: ‘Some’what Dovish Hike Not Enough for Stocks”